In my last article, I talked about the symbiotic relationship of customer experience and customer engagement, and provided some tactical items on how to form a digital strategy around both. In this article, I want to focus less on the how, and more on the why, especially when it comes to customer engagement.

If you’re reading this piece, it’s highly likely that you already saw the LIMRA study last year titled Extending the Life Insurance Value Proposition. If not, I highly suggest you read it. Like many of the insurers I’ve spoken with, we at Sureify found the outcomes of that study extremely compelling. We also found the results to be in perfect synchronization with what our Lifetime platform is designed to deliver. The study and others like it outline the changing dynamic in front of insurers based on the evolving expectations of their customers.

A few highlights from the study:

- 40% of millenials and Gen Z consumers expect financial, health and wellness guidance from their insurer.

- 87% of consumers say they are willing to share their health data with life insurers if there is some sort of incentive (usually a lower premium).

- 6 in 10 consumers believe life insurers will recommend good ideas to improve their health and advise them of treatments if they become ill. Consumers see alignment between their goals and the goals of life insurers.

- 7 in 10 consumers believe life insurers 1.) want them to live healthier lives, 2.) will safeguard against data breaches, and 3.) use their personal data appropriately.

- 97% of Americans say they want to improve one aspect of their overall wellness.

Let’s summarize a bit:

- People want to be healthier and are looking for help on how to do that. Nothing new there — Americans spend approximately $2.1 billion each year on weight-loss nutrition supplements alone. (from https://moderngentlemen.net/supplement-industry-statistics

- People are willing to share personal data if it benefits their health and their pocketbook. Again, maybe not groundbreaking — but solid validation that during the current (r)evolution of data stewardship, the general public is willing to provide personal information in the right context. (And why not? They give it away for free on Facebook, LinkedIn, Instagram, etc.!)

- The majority of consumers truly believe that insurers have the same goals that they do, AND that those insurers will recommend information that is in the best interest of their policyholders. Now, compare that to the dynamics of a health insurer and a patient. It’s a groundbreaking shift in the changing dynamics of our industry, and it’s direct validation that the industry’s move from a risk-centric to a customer-centric focus is working at strengthening the relationship between insurers and insureds.

- Younger buyers, the “now and future customers” of the life insurance industry, are demanding more from carriers. They expect to have a holistic relationship with your organization that not only provides insights to living a physically healthier life, but also guides them in mental health and financial fitness as well. This may seem unusual — except that insurers are in the perfect position to provide this guidance.

The longer a policyholder lives, the better it is for all parties. So then, if what we are selling is financial protection and life planning, insurance products should be supplemented with educating policyholders on the evolving best practices of health, wellness and financial fitness. In addition, insurers have two distinct advantages that help do this:

- Depending on the product line, they own arguably the best datasets on the planet, containing medical insights, personal health information, and life expectancy calculations.

- They are represented by financial professionals who are experts on financial fitness and wealth protection.

The alignment is like two puzzle pieces coming together, but very few insurers are actually making the right investment to both consolidate the right data and incorporate the right distribution strategies to drive engagement with their policyholders.

BCG, which collaborated with LIMRA on the “Extending the Life Insurance Value Proposition” study mentioned earlier, made the point perfectly: “Clearly, life insurers and consumers have a shared interest—increased longevity. This creates an opening for a higher level of engagement through wellness and could allow carriers to form stronger relationships with their end customers.” The tie between customers and life insurers is ultimately a perfect fit – and the life insurers who go beyond experience to provide value will continue to thrive.

So, how does this tie back to our primary focus on customer experience and customer engagement? Simple — the LIMRA article acts as a blueprint for building what customers are looking for, and both your CX and CE strategies should incorporate this type of information in a way that is engaging and insightful. The study demonstrates the clear shift (or the potential for one) in the insured / insurer relationship. It also presents a significant opportunity for both to gain more value.

The LIMRA study we’ve been referring to ended with some questions centered on how insurers can strategically incorporate this content into their products and services, as well as what the actual value is. We at Sureify feel like we have a unique perspective on this, especially given our platform’s focus on disseminating health, wellness and financial fitness in an engaging way that benefits both the insurer and policyholder. Below are the questions, along with some thoughts on the answers.

- How can insurers integrate holistic wellness into their long-term strategies?

In our opinion, integrating holistic wellness into an insurer’s strategy represents a huge opportunity to better align with their customers’ needs and future protection. But the key to a successful strategy is understanding that wellness is an extremely subjective concept. Your digital environment should enable the level of personalization required.

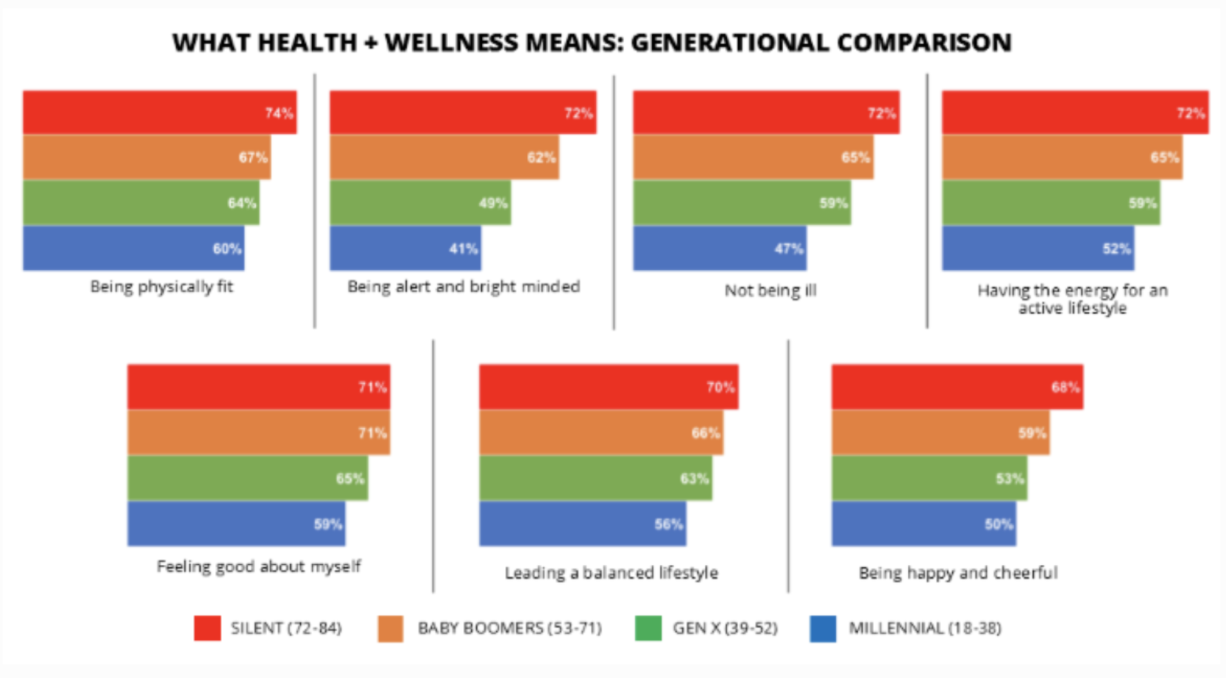

A Forbes article demonstrated the difference in what health and wellness means to different generations across 7 different attributes of wellness. “Consumers continue to view health and wellness holistically, as maintaining balance in physical health, mental health, and lifestyle. Older consumers are more likely to think of health and wellness more broadly than younger consumers, likely reflecting the larger role it may play in their lives.”

As shown here, the concept of “health and wellness” can vary across generational segments, so making it part of a long-term strategy requires enabling consumers to “choose their own adventure.” By allowing customers to select what is relevant to their current needs and lifestyle and then using the right technology to gather those insights and personalize future content, you will be supplying increasingly valuable information to each individual policyholder .

This approach enables a long-term strategy in two ways. 1) It evolves with the changing needs of the customer to ensure relevant content is being shared, and 2) It provides the insurer with a continuous stream of data and insight to evolve their products, services, and content, thus maximizing customer lifetime value.

- How can insurers identify the most valuable offerings?

There are two sides to value, but the obvious answer to this question is data. What is valuable to each customer can be easily assessed by tracking engagement. From a digital perspective, this means enabling an environment that allows for the testing of content and delivery mediums, and gathering the reactions and behavior of the customer. Is the access point mainly mobile? Does the customer prefer videos or quizzes vs a standard blog entry? What themes are being consumed the most? How do you increase and maintain a material participation rate?

Engagement — and more importantly, sustained engagement — is no small feat. Even some of the most popular social media apps in the world hover at around 29% for active users after launch. While we are seeing much better numbers with our customers, it is critical to understand that determining what is valuable is a time-consuming process of collecting data, testing, and iterating. In short, the way to identify the most valuable offerings is by establishing a digital platform that allows for testing the many necessary variables that go into engagement. Once that is established, you can react in a nimble way based on the insights collected and analyzed..

- What is the nature of the economic opportunity, and how can it be captured?

I will stay away from anything too calculated here and instead focus on some obvious outcomes that would present themselves with these types of initiatives.

First, what are some benefits for an insurer to pursue a health and wellness strategy?

- Stagnation and competition – According to Lewis & Ellis, “life insurance sales have slowed down in the last several years. In fact, the number of sales seen in the industry is down 45 percent over the last 20 years or so – as only about 1 in 5 households currently have such coverage.” In addition, traditional insurers are facing increased competition from new places like fully digital organizations, and entrants like Amazon who look to change the business model by becoming self-reliant. The industry is in the midst of a transformation. As products are increasingly commoditized, it is imperative that insurers separate themselves and create brand loyalty. Health and wellness presents a value add that can create differentiation.

- Healthy = good – A healthier populace is in the best interests of everyone. Again, per Lewis & Ellis, the benefits are “not having to pay as many death benefits thanks to people living healthy lives, and simultaneously providing incentive for more people to take on these policies by reducing their costs. This extra incentive could be positive for both the insurer and the insured.”

Second, what is the actual value of a robust engagement program that focuses on health and wellness initiatives

It’s difficult to put a ROI on engagement, but no doubt, you know it when you feel it. It’s the waiter that gives you a genuine smile and a little extra attention, or the shop owner who knows you by name and gives you a special discount for being a regular customer. Engagement that comes from your appreciation for your customers turns those customers into evangelists, and leads to positive reviews, beneficial word of mouth and above all, persistency.

From ThinkAdvisor.com: “More engaged consumers equate to lower costs and reduced churn, which benefit policyholders and insurers alike. Further, competitive advantage results when consumers spread the word about a company’s great service or helpfulness in solving a problem (whether it’s related to a specific claim or a broader topic like retirement planning).”

- What capabilities must insurers add to develop the most promising extensions?

The possibilities for digital enablement are endless, but it will be important for all insurers to begin and end the modernization journey with the end user in mind. Leading consultancy firm Tata sums it up: ”The starting point is to be informed by data, driven by empathy, and focused on real change. Once an organization has a firm view of customer patterns and preferences, and the current state of its CX, it can turn to techniques such as design thinking, and enablers such as artificial intelligence and advanced machine learning, to develop new methods of delivering a CX that offers significant ROI.”

In Sureify’s opinion, there are four absolutes that should be a part of every strategy focused on customer engagement. They are

Incentives

Insurers who use data to capitalize on the business of engagement have the capability to build incentives that recognize real, individual progress.

A recent Harvard Business Review article noted, “Of all industries, insurance has a unique opportunity to align its commercial interests with preventive behaviors. Insurers, along with public services, can directly “monetize” better individual behavior as healthier or safer individual outcomes, lower claims costs, and improve risk pools, which can be translated into lower-priced premiums and a competitive advantage in the marketplace.”

Depending on a policyholder’s priorities, things like financial management, weight loss and even the use of online tools for mental health evaluations can cumulatively benefit insurers by cutting costs. So why not reward those policyholders with lower rates, free add-ons or unexpected bonuses like travel benefits? The incentive model will take hold as data continues to give insurers insight into customers’ habits – taking advantage of that data will be a key to encouraging ongoing engagement and evangelization.

A Multi-Faceted Approach

Creating immersive, valuable experiences for policyholders will take some creative thinking. Insurers who buy into building a multi-faceted approach will need to provide useful services that are being sought by the younger consumer — things like online meditation, sleep and health classes, mental health services, document management services and financial health guidance.

The multi-faceted approach should also bring into play the many touchpoints that insurers have access to in every minute of every day. There are many studies and reports that talk about the necessity of the omnichannel experience, but the lesson from all of them is this: Be everywhere all the time. I can’t stress this enough! Even before a customer thinks about life insurance, you should be not just present, but personal, offering exactly what is needed at all times. That is what data, powered by AI, allows. Offer, guide … then provide.

Evolving content

A constantly evolving data set also allows for constantly evolving content to be provided – again, to the individual, rather than to a demographic group. McKinsey notes the value of such data-driven targeting. “Personalization—or reaching customers with targeted messaging, offers, and pricing at just the right time—is the future of insurance marketing. Marketers were once limited to a handful of undifferentiated, periodic marketing campaigns. But today a wealth of customer data, analytical tools, and marketing technology allow companies to run hundreds of personalized campaigns continuously to improve acquisition, cross-selling, and marketing return on investment.”

An agile, customer-centric digital environment

Life insurance is, by its nature, a low-touch industry. To increase engagement, it will be important to create a digital environment through which the end user is invited to interact in any way that is convenient to access content they find interesting and valuable. That means that “content they find interesting and valuable” must be pre-determined, readily available and easily accessible.

It was these last questions from Extending the Life Insurance Value Proposition that inspired this article, and I hope that they inspire you as well. There is immense potential for life insurers and annuity providers to build a better engagement game, and there are countless new ways to engage, thanks to constantly evolving digital and data acquisition capabilities. The companies that can offer you guidance are numerous (and I, of course, think that Sureify and our Lifetime platform are superlative resources!) In the end, though, any extension of the value proposition must be centered around what is ultimately best for your customers – and when that benefits you as an insurer, we all benefit.